Project managers play a pivotal role in steering the companies toward success by carefully choosing and executing projects. The process of selecting the right project is not just a basic formality but a strategic decision. The selection of projects can significantly impact an organization’s bottom line. In this article, we’ll delve into various project selection methods for project managers that propel their companies forward.

Introduction:

Project selection methods provide a lay of time-tested techniques based on sound logical reasoning to select a project and separate out undesirable projects with a low probability of success. When you have a number of gripping and challenging projects to select from, finding a project that is the perfect fit for your team’s skill set as well as level of confidence leading to success is the first key step in effective project management. The following are the various project selection methods for project managers, let us discuss in detail.

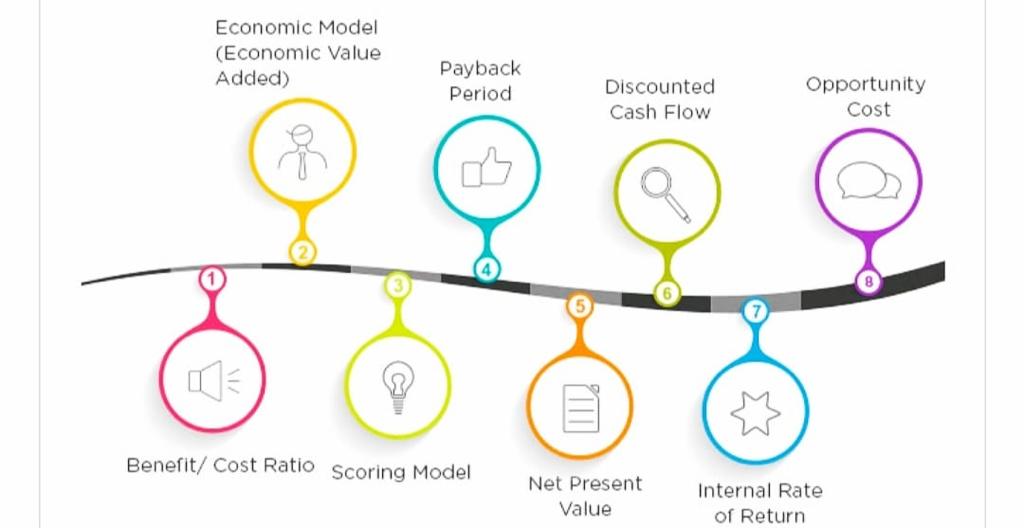

1. Benefit measurement methods

2. Economic model

3. Cost-Benefit ratio

4. Net present value

5. Scoring models

6. Payback period

7. Discounted cash flow

8. Internal rate of return

9. Opportunity cost analysis

10. Constrained optimization methods

11. Non-financial considerations

Various project selection methods in project management for project managers:

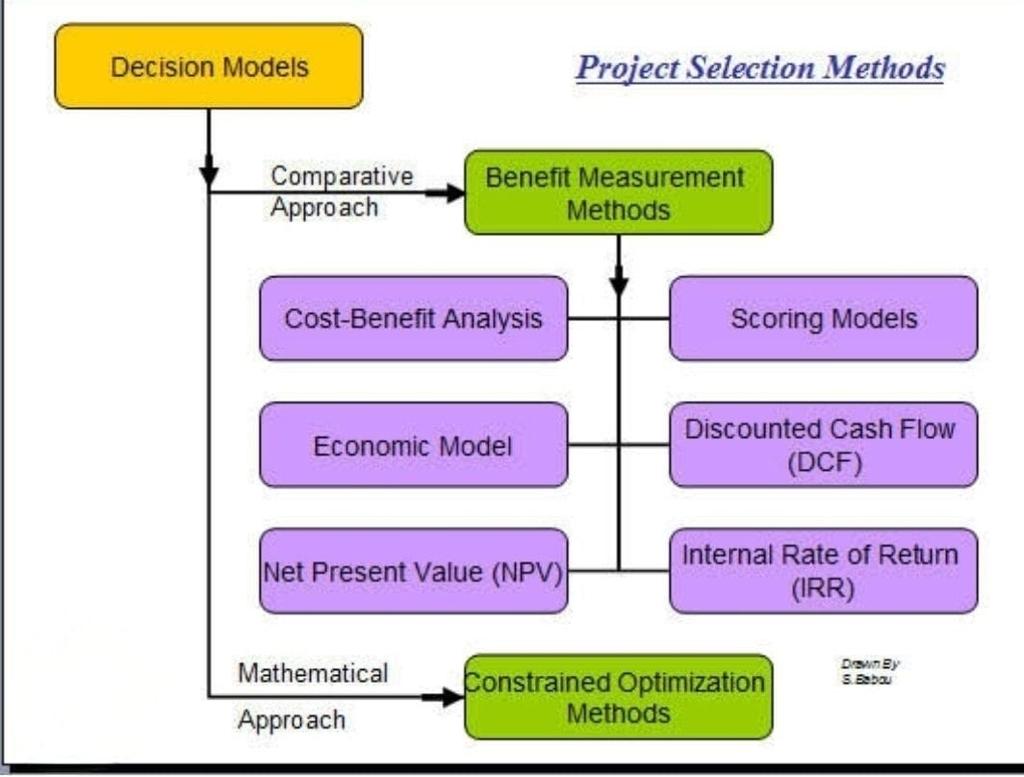

1.Benefit Measurement Methods:

At the forefront of project selection methods are Benefit Measurement methods.These methods ensure a thorough evaluation of potential advantages, marking the first step in the intricate dance of project selection. In these methods, project managers employ cost-benefit analyses, return on investment(ROI) calculations and other financial metrics to determine the viability of the project.

2.Economic Model:

The economic model is a project selection method that concentrates on evaluating the financial viability and economic impact of potential projects. This method entails analyzing diverse financial metrics to establish whether a project is economically feasible and aligns with the firms financial motives.

3.Cost-Benefit ratio(CBA):

Cost-Benefit ratio is a fundamental component of the economic model. It includes comparing the total expected costs of a project to the total expected benefits over a designated period. The aim is to ensure that the benefits exceed the costs.

Project managers employ CBA to quantify and compare both palpable and impalpable costs and benefits. CBA provides a broad view of the potential economic impact of a project.

4. Net Present Value(NPV):

NPV is a discounted cash flow technique that evaluates the present value of a project’s forthcoming cash inflows and outflows. It contemplates the time value of money.

Project managers use NPV to figure whether a project will lead to net gain or loss. They do this by comparing the present value of expected cash inflows and outflows. A positive NPV outlines that the project is economically viable.

5.Scoring models:

Scoring models give a structured approach to project selection by allocating scores to predefined criteria. These criteria, such as resource availability, strategic alignment and technical feasibility are stacked based on their importance.

Project managers employ scoring models to objectively compare and rank projects. This facilitates a systematic decision-making process for the project managers.

6. Payback period:

The payback period is the time that takes for the cash inflows and outflows to level the initial investment or cost of the project. Project managers use the payback period to assess how quickly any firm can recover its initial investment. Shorter payback periods are usually preferred.

7.Discounted Cash Flow(DCF):

The Discounted Cash Flow method provides a rigorous and widely accepted infrastructure for evaluating the financial attractiveness of a project. By integrating the time value of money, firms can make more informed decisions about investments and profits. This method ensures that selected projects contribute positively to the company’s value and financial goals.

The DCF method is widely employed in project selection, business valuation as well as investment analysis. This method accounts for the time value of money, conceding that a sum of money today is worth more than the same sum in the future due to its potential earning capacity.

In short, the DCF method is a financial valuation approach employed to assess the present value of a project or investment by discounting its expected forthcoming cash flows.

8. Internal Rate of Return(IRR):

IRR is the discount rate that makes the NPV of a project’s cash flows equal to zero. It indicates the project’s internal rate of return, representing the profitability threshold

Project managers employ IRR to evaluate the attractiveness of a project. Higher IRR values indicates a more favorable economic impact.

9.Opportunity Cost Analysis:

Opportunity cost analysis allows project managers to assess potential advantages forsaken by opting for one project over another. This method is deeply rooted in future insights. By equipping project managers with the ability to make decisions that can maximize benefits. This method also accounts for the potential opportunities lost in the project selection process.

10.Constrained optimization methods:

Constrained optimization is one of the project selection methods that involves identifying and choosing projects while considering diverse constraints or limitations. These constraints are imposed by factors such as resources, time, budget and other project-based restrictions. The agenda is to optimize the selection of projects within these limitations, maximizing the overall benefits or value to the organization.

Constrained optimization in project selection provides firms to make decisions that are both strategic and practical. By explicitly counting constraints the organizations can allocate resources effectively. The optimized selection process helps to meet project goals and navigate complexities of project management with a spotlight on achieving optimal outcomes.

11.Weighted Scoring Model:

The weighted scoring model intricates the scoring approach by inculcating stakeholder preferences into the equation. This method, standing at the crossroads of objectivity and inclusivity, exemplifies the dynamic nature of project selection methods. As criteria receive weights based on their significance, project managers ensure a comprehensive view that reflects the opinions of key stakeholders.

12. Non -financial considerations:

In project selection, non-financial considerations play a key role alongside financial metrics. They provide a more elaborate view of a project’s potential influence on an organization. While financial metrics like cost and return on investment are significant, non-financial aspects encompass a range of qualitative factors that impact decision-making.

Here are some important non-financial considerations in project selection.

- Strategic alignment

- Risk assessment

- Stakeholder impact

- Strategic fit

- Regulatory compliance

- Environmental and social impact

- Technology feasibility

- Organizational culture

- Flexibility and adaptability

- Timeline and urgency

In summary, incorporating non-financial aspects into project selection improves decision-making by providing a comprehensive view of a project’s potential impact. Leveling both financial and non-financial considerations ensure that project’s align with firms overall goals. Thereby, contribute to sustainable success.

Non-financial considerations also known as Multi-Criteria Decision Analysis(MCDA) method of project selection employed by project managers.

Project selection in project management:

Project selection in project management is a crucial phase that enables the course for organizational success. Effective project selection ensures that resources are invested in initiatives focused with strategic goals. Let’s explore the intricacies of project selection, delving into major considerations and methodologies.

1. Importance of Project selection:

Project selection in project management is related to choosing the correct path on a complex journey. It involves recognizing projects that associate with the company’s vision and objectives. The first step determines the resource trajectory, time, budget and efforts emphasizing the critical act of strategic decision-making.

2. Criteria for project selection:

Establishing criteria for project selection in project management is predominant. Criteria may enclose factors like resource availability, feasibility, strategic alignment and potential influence on stakeholders. By determining clear criteria , project managers create an infrastructure for assessing and comparing various projects. Thereby, ensuring a systematic and objective selection process.

3.Challenges in Project selection:

Directing the landscape of project selection in project management presents challenges for project managers. They often face hurdles such as aligning projects with organizational goals, balancing competing priorities and anticipating potential risks. Acknowledging these challenges is pivotal for implementing rigorous project selection methodologies.

4. Project selection methods:

Project selection methods in project management enclose various approaches. Each of these methods serve a specific purpose .Some methods such as Benefit measurement methods, Scoring models and MCDA stand out as effective tools. These methods supply managers with well structured frameworks. The frameworks are meant for aligning with strategic motives, assessing project feasibility and making informed decisions.

Reference links:

Conclusion:

In conclusion, the process of project selection is a crucial aspect of project management that requires careful consideration and analysis. Project managers, by employing the above mentioned methods guide organizations toward success. The repetitive rhythm of “project selection methods” underscores the significance of an informed, systematic and strategic approach, where project managers stand as caretakers of organizational prosperity.

Project selection in project management is a dynamic process that commands careful consideration and strategic foresight. By emphasizing the significance of criteria, leveraging effective project selection methods project managers pave the way for successful project outcomes. Acknowledging challenges, project selection highlights its significance in the company’s success.

FAQs:

1Q: What is project selection in project management?

1A: Project selection in project management is the process of assessing and choosing projects depending on diverse criteria. This ensures that they align with firm goals and priorities. It helps to determine which projects will be undertaken and which will be excluded from the project portfolio.

2Q: Why is project selection significant in project management?

2A: Project selection is important because it directs organizational resources toward projects that are strategically aligned and have the maximum probability for success. It ensures that limited resources such as manpower, time and money are invested in initiatives that subsidize the most to the firm’s objectives.

3Q: What are the key criteria considered in project selection methods?

3A: Key criteria in project selection methods include resource availability, strategic alignment, risk assessment, feasibility, stakeholder impact and financial viability. These criteria vary based on the particular project selection method used.

4Q: How do project managers balance financial and non-financial considerations in project selection?

4A: Project managers balance financial and non-financial considerations by evaluating both quantitative metrics like return on investment and qualitative factors such as stakeholder impact, strategic alignment and organizational culture. This ensures an elaborate decision-making process.

5Q: What are the five criteria for project selection?

5A: The five important project selection criteria are as follows:

- Evaluation of resource availability and capabilities.

- Data availability and estimated revenue.

- Strategic alignment with future business goals.

- Assessment of potential risks.

- Brand loyalty and the potential impact on customer satisfaction.