The Association of Chartered Certified Accountants (ACCA) is a globally recognised and celebrated qualification for finance professionals. It has developed itself as the finest standard in accountancy and finance management. This beautifully designed program hones expertise in financial management, auditing, taxation, and strategic business leadership, boosting aspiring and experienced finance professionals to click on remarkable ACCA careers worldwide. It combines rigorous technical knowledge, strong professional ethics, practical exposure, and forward-thinking leadership skills. ACCA propels finance professionals toward long-term success.

In this comprehensive guide, let us explore why ACCA is the ideal choice for finance professionals.

What is ACCA, and why every financial professional should know about it?

ACCA (Association of Chartered Certified Accountants) is a governing UK-based global professional accounting body that provides world-class qualifications in accountancy, finance, and business. It makes the finance professionals strategically ready through its balanced curriculum that focuses on technical excellence, ethical awareness, and leadership capabilities.

The ACCA Qualification covers aspects of traditional accounting and finance management, performance management, taxation, audit, and corporate governance. It also prioritises the concepts of professional ethics and leadership development. For any finance professional aiming for versatile, future-proof ACCA careers—whether in multinational corporations, Big Four firms, public practice, or even entrepreneurial ventures—understanding and pursuing ACCA is almost essential. Senior roles like financial controller, CFO have many doors opened for them and its global portability means qualifications earned in one country are respected virtually everywhere, giving members a genuine competitive advantage in the international job market.

Purpose of ACCA for modern finance professionals-

ACCA delivers a globally recognised certification in accountancy and finance management.

It equips candidates with industry-relevant skills to meet the evolving demands of employers in an increasingly digitalised world.

Widely regarded as a top-tier credential for individuals pursuing ACCA careers in accounting, auditing, taxation, and senior finance management roles. Acca sharpens the skills of the candidates in the field of finance management, finance professionals, and accounting, so that you start becoming a part of robust, flexible, prestigious companies worldwide. Trainers also educate on the significance of integrity to exist firmly in this dynamic job market.

Key Features of the ACCA Qualification for finance professionals-

- Comprehensive curriculum covering financial reporting, performance management, audit, taxation, and finance management.

- Globally recognised in over 180 countries – perfect for finance professionals seeking international mobility.

- Dedicated Ethics and Professional Skills Module.

- Mandatory to draw 36 months of practical work experience to achieve full membership status.

Who can pursue ACCA?

A perfect fit for every finance professional. Candidates aspiring to excel in accountancy, finance management, or senior management roles.

Individuals planning to boost their expertise with a prestigious, globally accepted qualification in the field of finance professional development.

Comparing ACCA and CA

As a finance professional, whatever doubts you have, allow this table to clear all your doubts with accurate information.

| ACCA | CA |

| ACCA global qualification with international standards (IFRS), offering broader ACCA career opportunities in over 180 countries. | CA (Chartered Accountant) is a national-level qualification focused on Indian accounting standards, taxation, and law |

| whereas ACCA is ideal for those seeking global mobility and broader financial and management roles. | CAs are often better for specialized roles within India, especially for statutory audits. |

Eligibility criteria to start your ACCA journey

All the finance professionals should complete 10+2 and secure a minimum of 65% in Mathematics/Accounts and English, and 50% in other subjects. Graduates and other working professionals in finance or commerce will be exempted on the eligibility criteria based on their previous qualifications. After registering, it becomes compulsory to pass all ACCA exams and gain 36 months of relevant work experience to gain the full ACCA qualification.

Job opportunities associated with ACCA

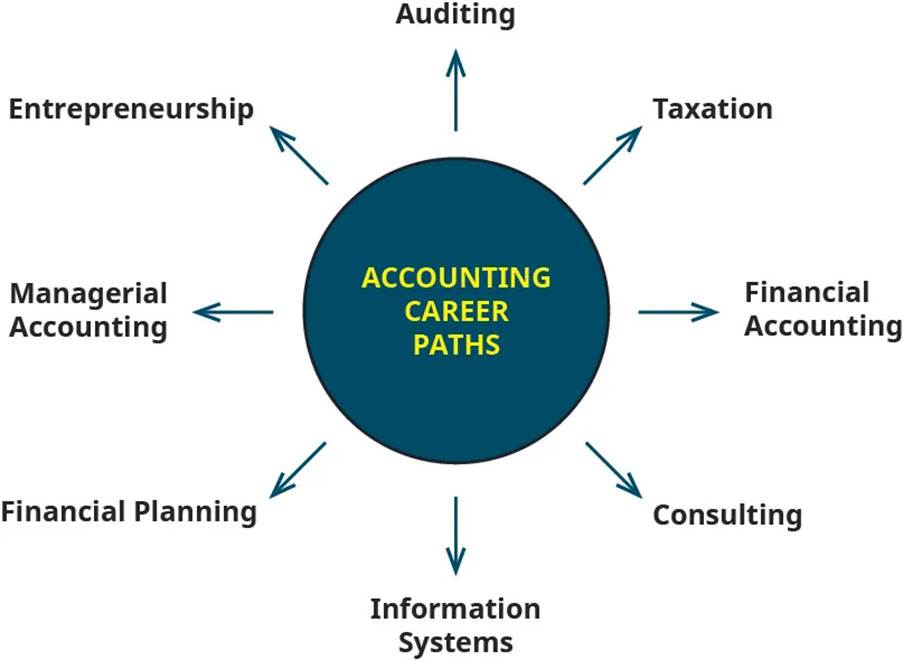

ACCA careers unlock vibrant scopes and diversified roles in accountancy and finance management-

- Bookkeeper → Accounts Manager → Financial Controller → CFO

- Auditor, Tax Specialist, Business Analyst, Risk Manager, Compliance Officer, Treasury Analyst, and more

- Top multinational employers actively seek ACCA-qualified finance professionals for their global outlook and technical expertise.

How does ACCA train financial professionals?

ACCA builds well-rounded finance professionals through three pillars-

- Technical Excellence: Mastery in financial reporting, performance management, taxation, audit, and finance management.

- Practical Experience Requirement (PER): 36 months of supervised work + successful demonstration of 9 performance objectives (5 Essentials + 4 Technical).

- Ethics & Professional Skills: compulsory module created to ensure every ACCA member carries the highest ethical standards.

Join Henry Harvin to become an ACCA-Certified Finance Professional

Kickstart your ACCA career with Henry Harvin’s industry-leading programs:

- 44 hours of live interactive online sessions

- Projects in Financial Accounting, Audit & Assurance, Strategic Business Reporting, etc.

- 52+ Masterclasses | 1-Year Gold Membership | Internship support with J.P. Morgan, Accenture & more

2. Dual Degree: M.Com Accounting & Finance + ACCA

- 2-year integrated program with global recognition

- Real-time projects in investment banking, corporate reporting, etc.

- 18 Months Gold Membership | Internship opportunities via top MNCs

Learning Benefits

- Gives a deep understanding of finance management, cost accounting, budgeting, and forecasting

- Efficiency in accounting software and data analytics

- Global connection + mastery over audit, taxation, corporate reporting, and strategic leadership

List of companies hiring ACCA-certified finance professionals-

Finance professionals are hired by many companies with promising roles and guaranteed good packages.

| Company | Expected Roles | Salary package |

| Deloitte | Audit Associate, Tax Consultant, Financial Analyst | India: freshers- Rs 5 LPA Experienced- Rs 15 LPA |

| PwC | Assurance Analyst, Risk Advisor | India: freshers- Rs 4.5 LPA Experienced- Rs 14 LPA |

| EY | Finance Manager, Compliance Specialist | India: freshers- Rs 6 LPA Experienced- Rs 18 LPA |

| Barclays | Credit Analyst, Finance Controller | India: freshers-Rs 7 LPA Experienced- Rs 20 LPA |

| HSBC | Risk Management Specialist, Treasury Analyst | India: freshers- Rs 6 LPA Experienced- Rs 22 LPA` |

| BDO | Assistant Accountant, Audit Senior | India: freshers- Rs 3.5LPA Experienced- Rs 10 LPA |

Conclusion

Choosing ACCA is one of the decisive career moves for anyone aspiring to become a top-tier finance professional. With a good mixture of technical depth, practical experience, and global recognition in accountancy and finance management, ACCA unlocks the door to unlimited ACCA career opportunities across the world. Enrol today with Henry Harvin and transform yourself into a globally sought-after finance professional.

Let me tell you why this qualification feels like a game-changer every single time I speak to someone who has completed it. In the current time frame, where finance roles are becoming more strategic, interconnected, and heavily regulated, ACCA teaches about everything, starting from performance management and audit assurance to taxation, financial reporting, and even strategic business leadership. National level qualifications sharpen you in technical accounting, but ACCA prepares you for a big boardroom decision with finance. With this Affordable ACCA Course, many of the complicated financial challenges can be solved to a great extent.

Recommended Reads

- Top 10 GST courses in Mumbai: 2023

- Top 10 Junior MBA Courses Online in 2023

- ACCA Qualification Structure and Requirements Guide

- ACCA Curriculum Change 2026: 30 Most Common Questions Answered

- Explore ACCA SUBJECTS LIST: 2025-2026

FAQ’S

Ans- Absolutely! ACCA is one of the most respected qualifications in accountancy and finance management worldwide.

Ans- Yes, Henry Harvin refers candidates to partner companies and top MNCs.

Ans- Yes, sessions are 100% live online with complete scheduling flexibility.

Ans- No, Henry Harvin offers high-value ACCA programs at moderate and competitive pricing.

Ans- yes, Henry Harvin provides a good discount in many of its courses.